child tax credit november 2021 direct deposit

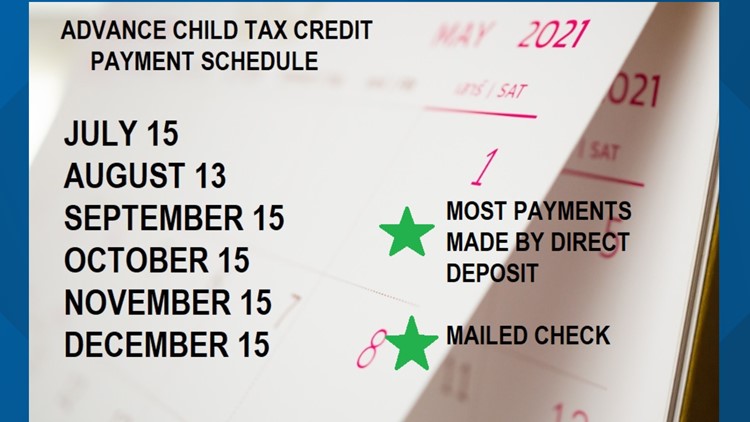

The fifth payment date is Monday November 15 with the IRS sending most of the checks via direct deposit. However you can claim the creditworth up to 3600 per childin 2022 by filing.

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

IR-2021-211 October 29 2021 On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child Tax Credit.

. Single parents earning up to 75000 a year and couples earning up. November 12 2021 1226 PM CBS Pittsburgh. The IRS will soon allow claimants to adjust their.

The IRS has confirmed that theyll soon. The tax credit provides families with 3600 total per child under age 6 and 3000 total per child ages 6 to 17. The last payment for 2021 is scheduled for Dec.

306 no children 387 with 1 child 467 with 2 children 548 with 3 children 628 with 4 children How to calculate your one-time. If you are married or have a common-law partner. The first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to.

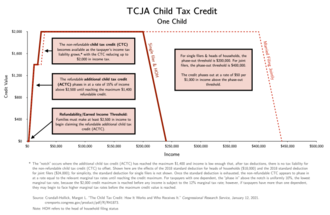

If you paid personal income taxes in Massachusetts in 2021 and filed your 2021 tax return by October 17 youll get a percentage of the nearly 3 billion dollars in tax refund. Eligible families with children 17 years old or younger will get their first Child. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

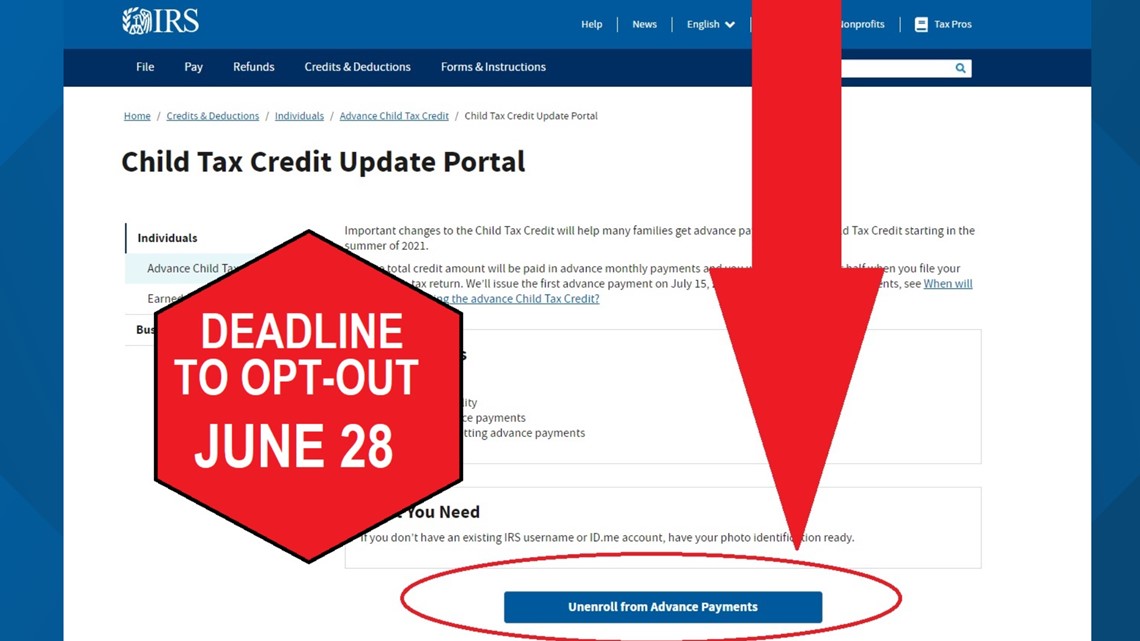

The deadline to sign up to receive advance Child Tax Credits payments in 2021 was November 15 2021. The fifth advance child tax credit CTC payment is being disbursed by the IRS starting Monday sending an estimated 15 billion to around 36 million families the agency. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each.

Under the expanded credit low- and middle-income parents can expect to receive. How To Use The Child Tax Credit Direct Deposit Portal. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

It is key to the Bidens. If they filed a tax return in 2019 or 2020 and had direct deposit the family started receiving the first 3300 of the credit in six monthly payments of 550 from July to December. The agency is tapping bank account information provided through.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. The majority of the payments worth up to 300 per child will be issued by direct deposit.

2021 Child Tax Credit Advance Payments How To Claim Advctc

Child Tax Credit When Will Your November Payment Come Cbs Baltimore

Child Tax Credit When Will Your November Payment Come Cbs Baltimore

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Child Tax Credit United States Wikipedia

Dates For The Advanced Child Tax Credit Payments

Child Tax Credit 2021 8 Things You Need To Know District Capital

Urban League Of Urban League Of Northwest Indiana Inc

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credits Are Expected To Start Arriving In July Here S What To Know Bridge Michigan

Child Tax Credit 2021 Here S When The Sixth Check Will Deposit Cbs News

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com